The Cost of Inaction: Recognising the value at risk from climate change

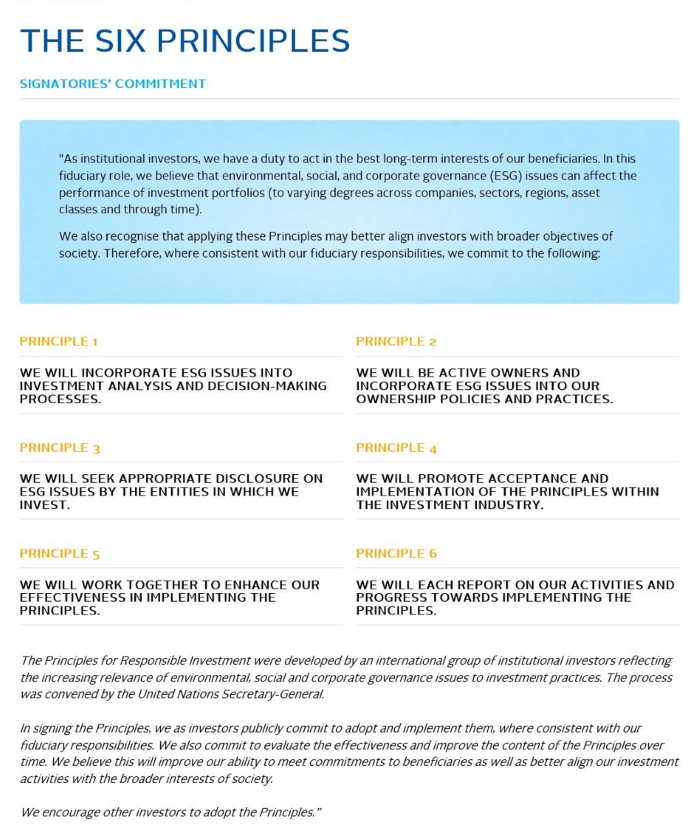

The implications of climate change should be of concern to everyone. Those entrusted with investing or managing the assets of others, especially long horizon pension assets, bear the fiduciary responsibility to consider the potential investment implications of climate change. This paper, published in 2015 by The Economist's Research Intelligence Unit with support from Aviva, is every [...]